VIRGINIA EDUCATION IMPROVEMENT

SCHOLARSHIP TAX CREDIT

Background

The EISTC, established in 2013, and administered by the Virginia Department of Education, has given thousands of vulnerable students across Virginia the opportunity to attend private schools in their communities. The scholarships students receive are made possible as a result of the EISTC.

How it works

The EISTC allows private donors and businesses to make donations of $500 to $125,000 to private school scholarship foundations and receive a 65% tax credit against their annual state tax liability. The program is capped at $25 million and credits are awarded on a first come, first served basis. In FY19 (the latest year reported), the EISTC accounted for $10.9 million in tax credits and supported 4,710 scholarships to students across the Commonwealth. Private scholarship foundations that receive these contributions then administer scholarship programs to eligible students in partnership with private schools.

Why It’s Important

- The EISTC provides equitable opportunity for Virginia’s most vulnerable students to receive the highest quality education they deserve.

- Opportunities to attend private schools should not depend on a student’s socioeconomic background and the quality of their education should not depend on their zip code.

- For the cost of every $1 in Education Improvement Scholarship Tax Credits in FY19, the Commonwealth saved $2.10.

- The EISTC does not remove or divert funding away from public schools. Private dollars fund private school scholarships. Public dollars do not.

- The EISTC is not a voucher program. Private donations funding scholarship programs are funds that never touch state coffers. Virginia does not have a state funded and administered voucher program.

- Schools that provide EISTC scholarships are mandated to follow strict reporting and accreditation guidelines under state and federal law, and recipients of scholarships must meet narrow criteria.

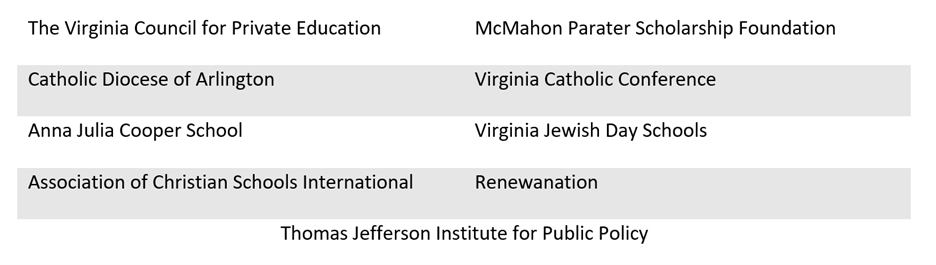

About Virginia Parents Coalition

The coalition officially formed at the beginning of 2020 in order to ensure the Education Improvement Scholarship Tax Credit (EISTC) program’s continued success in Virginia. The coalition is made up of the following associations/groups, which represent a vast array of scholarship granting organizations (SGOs) from across the Commonwealth: